Business valuation: How much is my practice worth?

You’ve spent years building your dermatology practice, and you consider it one of your most rewarding accomplishments. Now, you’re ready to retire. And you’re wondering how, when, and where to sell. Perhaps most importantly, you're wondering how to set the right price.

Business valuation is both an art and a science. You’ve probably heard of many methods to determine a company’s value, but you might be most familiar with the accounting acronym EBITDA. Read on for some frequently asked questions about this formula.

How much is my medical practice worth? An EBITDA Q&A

Question: What is EBITDA?

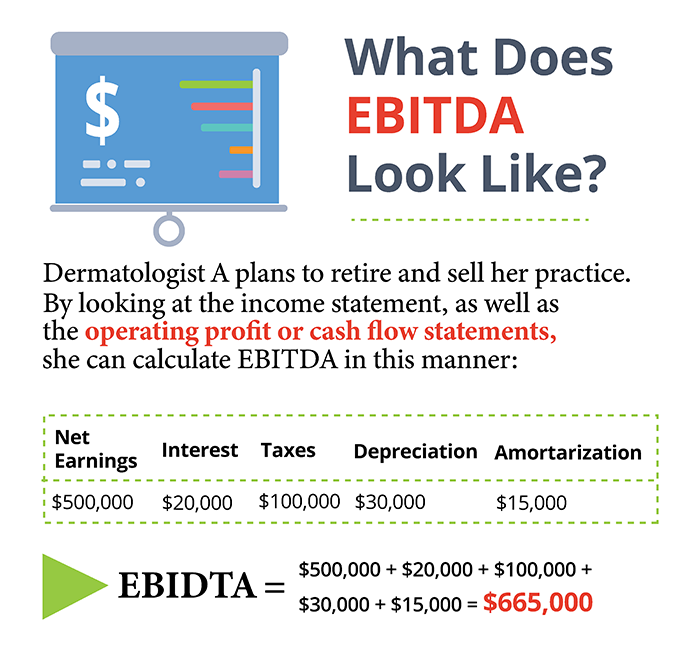

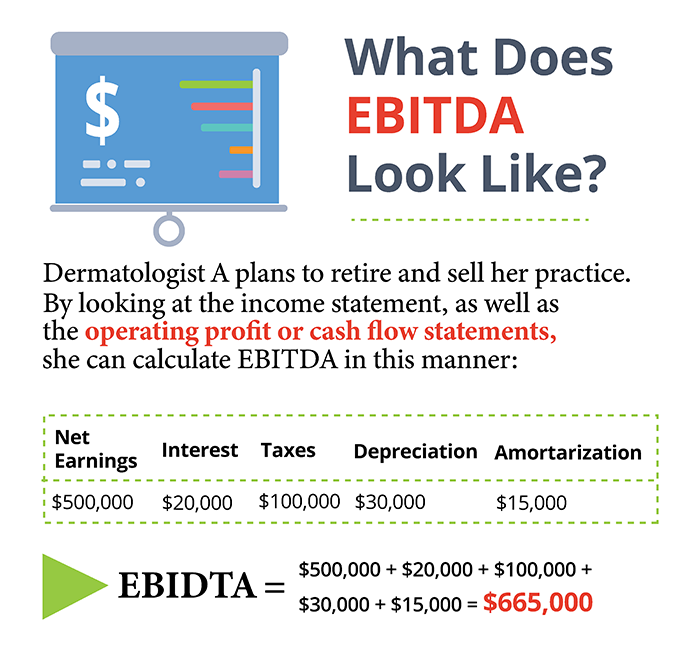

Answer: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. In essence, it’s a measure of your company’s fiscal condition and an indicator of your practice’s earnings potential. For the purposes of this calculation, earnings refers to net earnings after deducting overhead.

Question: How is EBITDA used?

Answer: Investors use EBITDA to estimate a business’s net income before deducting interest, taxes, depreciation, and amortization. Why? These factors can vary from company to company. EBITDA can help predict a company’s profitability in the long run and its ability to pay off debts.

While EBITDA is not a good measure of liquidity, it’s a number many investors want to see. It can help them make an “apples-to-apples” comparison of potential profitability when looking at multiple businesses.

Question: How is EBITDA unique?

Answer: Unlike estimates of net income, which involve a general “revenue-minus-expenses” formula, EBITDA goes further. It excludes:

Interest, because financing choices can vary widely between companies.

Taxes, which can result from acquisitions and losses in prior years, and skew a company’s net income.

Depreciation and amortization, which can be calculated using different formulas and also can be fairly subjective measurements.

EBITDA infographic

Question: Why use EBITDA?

Answer: EBITDA shows a higher value than earnings alone. It can help a business highlight its success, even if it isn’t currently making a profit.

Investors often estimate a company’s value as a multiple of EBITDA, depending on sales, the company’s financial health, and other factors. This helps them create a picture of future cash flow.

In the example above, if an investor estimates the multiplier as five, the company would be worth: $665,000 x 5 = $3.3 million

Question: What limits does EBITDA have?

Answer: Although nearly 80% of equity analysts use EBITDA, it’s not a generally accepted accounting principle (GAAP) and should not be used as a sole source of valuation.

While EBITDA provides a positive outlook for a business, it doesn’t provide a full picture of cash flow and working capital.

Question: What’s the EBITDA Margin?

Answer: Many potential investors use the EBITDA Margin estimate to create a clearer picture of future cash flow: EBITDA Margin = EBITDA divided by total revenue.

In the example above, if the company’s total revenue was $1.4 million, its EBITDA Margin would be: $665,000 divided by $1.4 million = 48%

This formula provides a look at how much of a company’s profits are taken up by operating expenses. The higher the EBITDA margin, the more financially solid the company is said to be.

Question: How else can you set a value for your business?

Answer: In addition to using EBITDA, it’s important to take into account a range of other factors, including:

Your practice’s efficiency and profitability

Referral patterns

Your age and whether you will continue working with the practice for a set period of time

Your practice’s insurance mix

Reimbursements, current and future

Economic climate

Question: Are there other methods for setting a value for your business?

Answer: Yes: The multiplier method multiplies your revenue by a number that is an industry standard.

For example, in the past, primary care practice multipliers were set at 1 to 1.25. So the formula would be: 1 x annual gross revenue (up to 1.25 x annual gross revenue).

However, multipliers have generally fallen over the years and can vary from practice to practice, so other approaches may be more desirable.

The asset-based approach adds together the tangible and intangible assets of a company to form a valuation. One caveat: While it is simple to calculate, it does not take into consideration earning potential.

Question: What’s the bottom line?

Answer: EBITDA, along with other financial calculations, is an important piece of the puzzle when you’re trying to set the value of your practice. But numbers alone aren’t everything. Also consider:

The time, money, and passion you invested in your business

Your practice goodwill

The expertise of your team

The worth you have assigned to your practice

If you stand by the value that feels correct to you, you won’t settle for less than you deserve.

Related AAD resources

Practice types: See our full menu of resources on practice types, from solo to institutional.

Get started: Access our guide to getting started in practice, with resources on practice types and policies and procedures.

Employment guide: See all our resources on contracts, questions for employers, and more.

This content is only for informational purposes and is not intended to substitute for the guidance of an attorney, professional business consultant, or financial adviser. Always seek professional guidance before agreeing to an employment contract, selling a business, retiring, or making any other type of career decision.

Find a Dermatologist

Find a Dermatologist

Member directory

Member directory

AAD Learning Center

AAD Learning Center

2026 AAD Annual Meeting

2026 AAD Annual Meeting

Need coding help?

Need coding help?

Reduce burdens

Reduce burdens

Clinical guidelines

Clinical guidelines

Why use AAD measures?

Why use AAD measures?

Latest news

Latest news

New insights

New insights

Physician wellness

Physician wellness

Joining or selling a practice?

Joining or selling a practice?

Promote the specialty

Promote the specialty

Advocacy priorities

Advocacy priorities